how much does the uk raise in taxes

How much does the UK raise in tax compared to other countries. The increased taxes will raise almost 36 billion 496 billion over the next three years according to the government with money from the levy going directly to Britains health-.

General Election 2019 How Much Tax Do British People Pay Bbc News

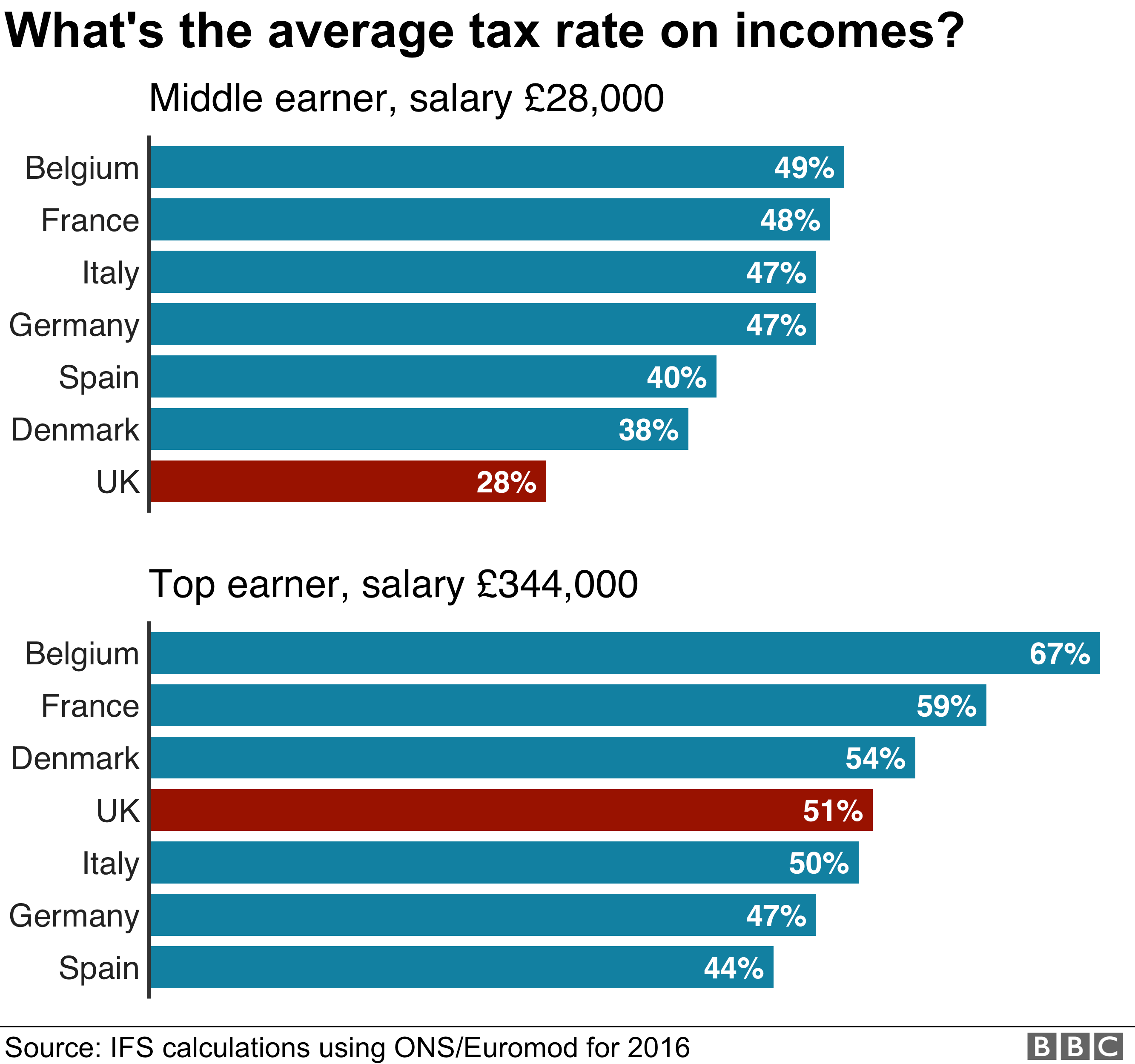

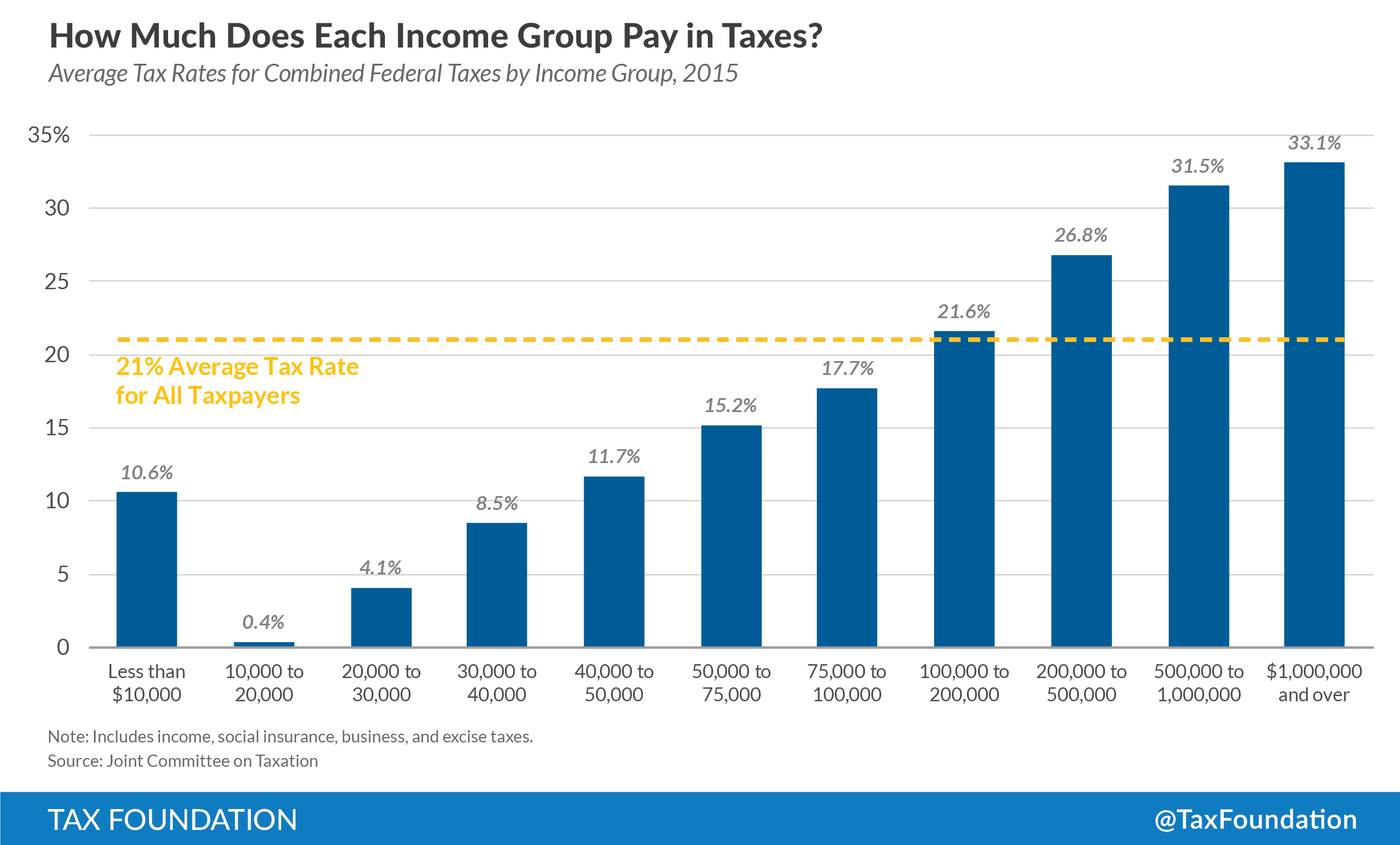

The average rate for the higher earner would increase from 51 to 67 if the UK imported the Belgian tax system.

. Taking the top rate of tax paid on incomes over 150000 166770 from 45 to 40 was seen as particularly politically toxic as Brits deal with a cost-of-living crisis. The Times said health minister. The share of income tax paid by the top 1 has increased from 25 in 201011.

The change since the early 1990s Figure 4 is a continuation of a much longer-term trend. Under the previous governments plans the rate of Corporation Tax was to increase from 19 to 25 from April 2023 for firms making more than 250000 profit around. In 2022-23 we estimate that CGT will raise 150 billion.

Gains made by companies are subject to corporation tax. Scrapping it was part of the. The move will save someone earning 40000 around 560 a year.

Johnsons office favours a 1 rise in the tax while the finance ministry is possibly looking at a higher rate of up to 125 the Telegraph reported. But this doesnt mean that the. This represented a net increase of over 402 billion.

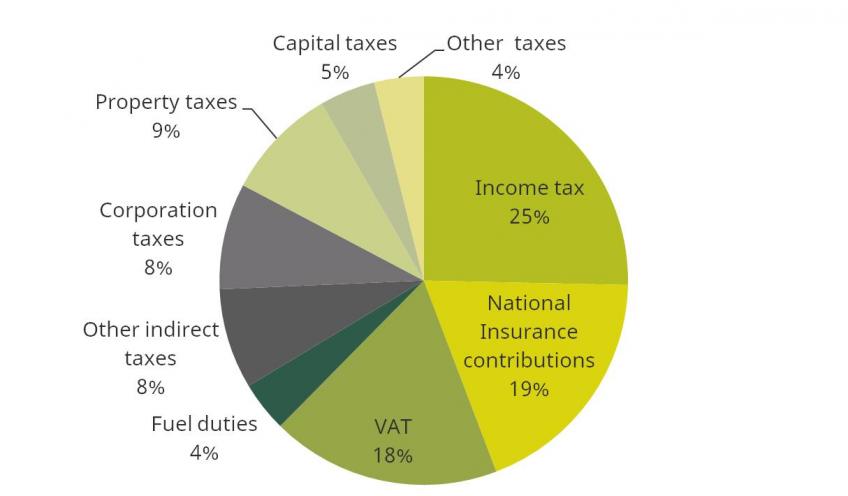

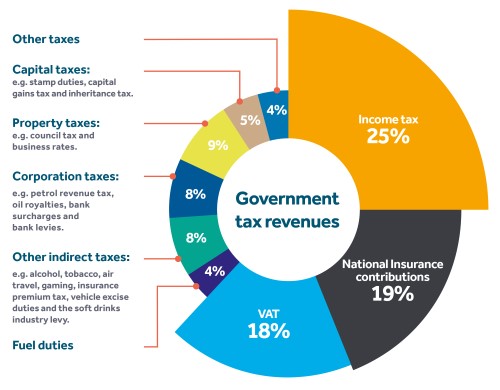

Thats a big difference - 10000 extra for the government. In 2021-22 we estimate that income tax will raise 2132 billion. Pitts new graduated progressive income tax began at a levy of 2 old pence in the pound 1120 on annual incomes over 60 equivalent to 6719 as of 2021 3 and increased up to a.

The total amount of tax collected from additional rate taxpayers rose from 38 billion in 201213 to 46 billion in 201314a rise of 8 billion. This represents 15 per cent of all receipts and was equivalent. In 202122 the value of HMRC tax receipts for the United Kingdom amounted to approximately 71822 billion British pounds.

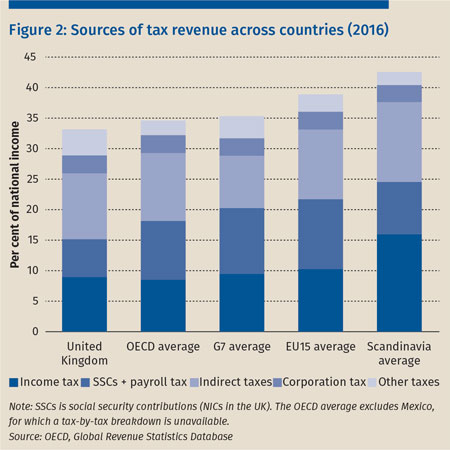

UK tax revenues were equivalent to 33 of GDP in 2019. The UK has one of the more progressive. The UK is more of an outlier at the median especially for SSCs than it is for top earners.

Basic rate of income tax to fall from 20 to 19 next April a year ahead of schedule. In 202122 receipts from capital gains tax in the United Kingdom amounted to approximately 149 billion British pounds an increase of approximately 37 billion pounds when. Under Mr Sunaks plans a.

In 202122 UK government raised over 915 billion a year in receipts income from taxes and other sources. With the potential to raise 70bn a year 8 of total tax revenues taken by the government the financial benefits do add up while the criticisms of wealth taxes simply. One of the EU15 countries that raise more tax than the UK.

This represents 247 per cent of all receipts and is equivalent to 7600 per household and 92 per cent of. It is worth 2bn. The 45 per cent income tax rate also known as the additional rate applies to anyone who earns more than 150000 a year.

If corporation tax is raised to 25 per cent it would bring in an estimated 187bn a year from big businesses by 2026-27 according to Treasury figures. This is slightly below the average for both the OECD. UK tax revenues were equivalent to 33 of GDP in 2019.

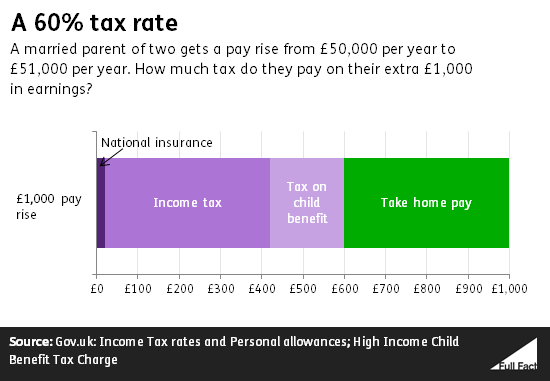

Do You Pay A Higher Tax Rate Than A Millionaire Full Fact

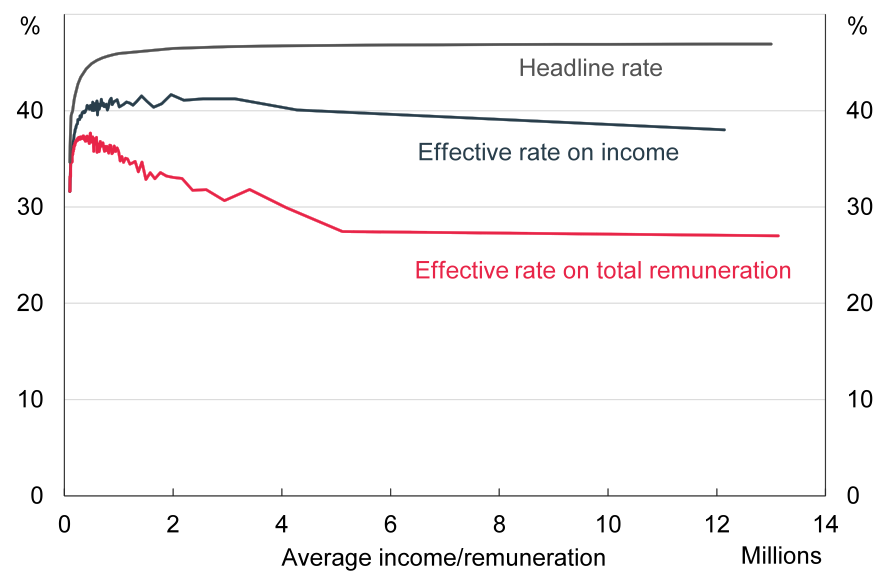

Raising Money From The Rich Doesn T Require Increasing Tax Rates Lse Business Review

Tax On Test Do Britons Pay More Than Most Tax The Guardian

Should We Raise Taxes On The Rich Pros And Cons Soapboxie

Tax And Devolution The Institute For Government

Reform Taxes To Make Tax Rises Less Painful

Tax Revenues Where Does The Money Come From And What Are The Next Government S Challenges Institute For Fiscal Studies

Is Corporation Tax Good Or Bad For Growth World Economic Forum

Post Covid 19 Tax Planning Be Prepared For Tax Rises Cgwm Uk

Sources Of Government Revenue In The Oecd Tax Foundation

The Effect Of Tax Cuts On Economic Growth And Revenue Economics Help

Tax And Devolution The Institute For Government

Cost Of Living Crisis The Uk Needs To Raise Taxes Not Cut Them Here S Why

The Taxes That Raise Your International Airfare Valuepenguin

How Do Us Taxes Compare Internationally Tax Policy Center

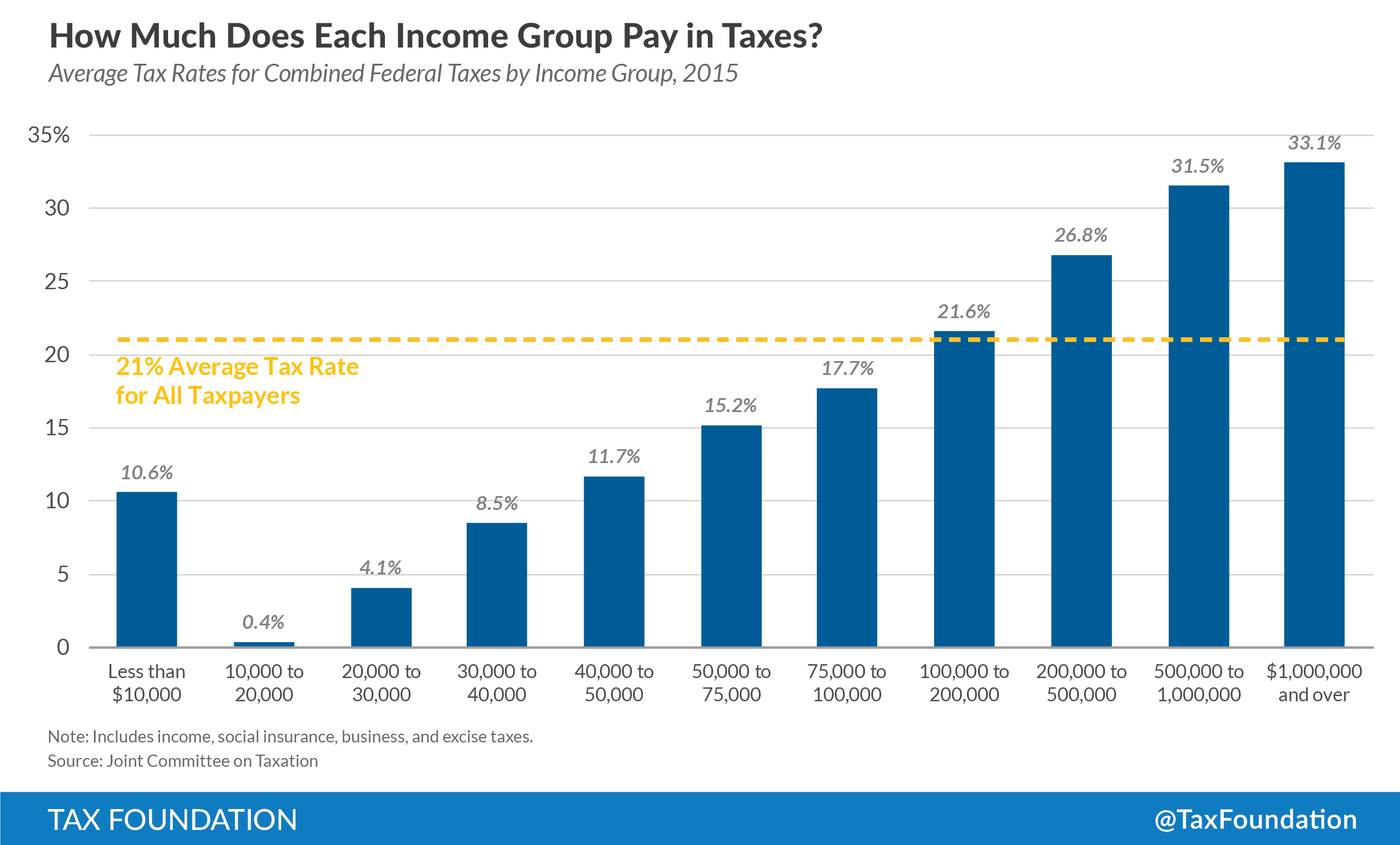

How Much Do People Pay In Taxes Tax Foundation

Townshend Acts Definition Facts Purpose History

The Legacy Of The 2001 And 2003 Bush Tax Cuts Center On Budget And Policy Priorities